Partnership Firm Registration in Dehradun Requirements, Procedure Fees

Partnership Firm Registration in Dehradun Fees @Rs.18,500/-Only and time period one month approx.

Call us at 8755017503

100% Approval

100% Online Process

Money back guarantee

Trustworthy Guidance

Partnership Firm Registration in Dehradun -Overview

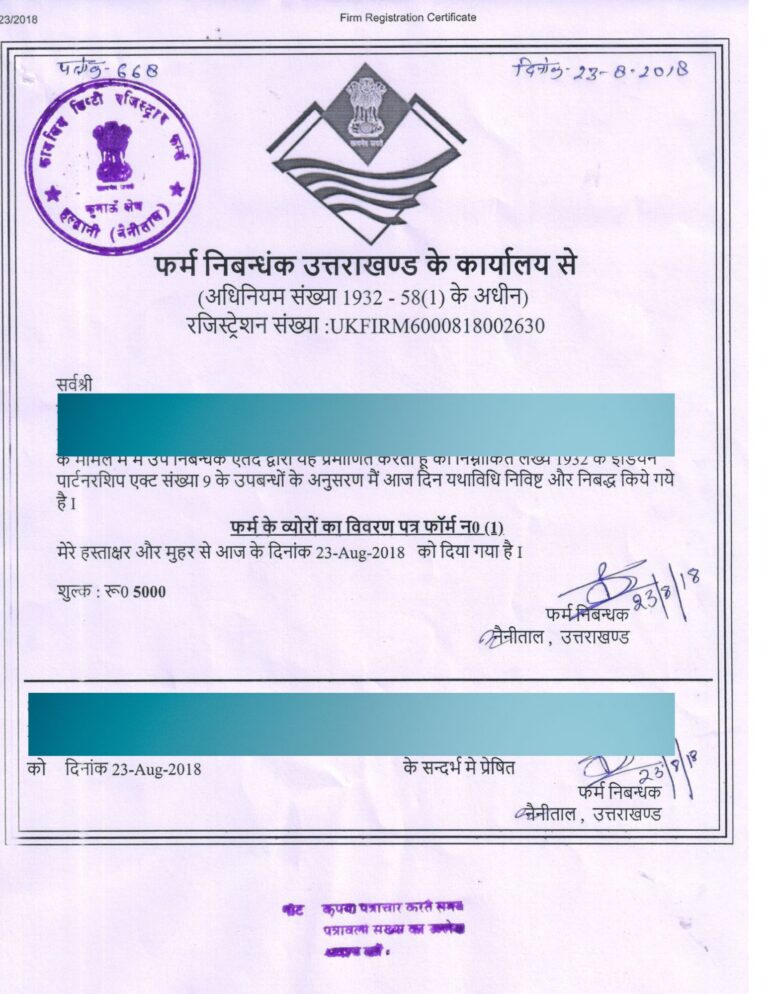

Sample Partnership Firm Registration certificate

Partnership Firm Registration in Dehradun

- Understanding partnership Firms in Dehradun.

- Indispensable Partnership Deed.

- The Process of Partnership Firm Registration.

- Government fees for partnership Firm Registration

- Time period for Partnership Firm Registration.

- Post Registration Formalities.

- Why Registration Partnership Firm -Advantages.

- The Pitfalls of Remaining unregistered..

- Post Registration Compliances.

- Frequently Asked Questions

Partnershhip Firm registration in Dehradun are done under Partnership Act. Though partnership registration act are comprehensively one in all over India, however every state government has made its own rules which also falls under partnership Firm registration . so there are little bit change in every state in registration process of partnership Firm.

Understanding Partnership Firms in Dehradun

At its core, a partnership firm is a business structure formed by an agreement between two or more individuals (partners) to share the profits of a business carried on by all or any of them acting for all. This definition, enshrined in the Indian Partnership Act, 1932, highlights several key characteristics:

- Agreement: The foundation of a partnership is a mutual agreement between the partners. This agreement typically outlines the terms and conditions governing their relationship, including profit and loss sharing, responsibilities, and capital contributions. While this agreement can be oral, it is highly advisable to formalize it in a written document known as a Partnership Deed.

- Two or More Persons: A partnership requires a minimum of two partners. While the Partnership Act doesn’t specify a maximum number, practical considerations and other regulations (like those related to banking businesses) may impose limitations. For general businesses, the suggested maximum number of partners is often considered to be around 20. All partners must be competent to make contract i.e. they should be of sound mind and have attained the age of 18 years.

- Sharing of Profits and Losses: A fundamental aspect of a partnership is the agreement among partners to share the profits and losses of the business. This sharing ratio is typically defined in the Partnership Deed. If no specific ratio is mentioned, the law presumes that profits and losses are shared equally among the partners.

- Mutual Agency: This is a crucial element of a partnership. Each partner acts as both a principal and an agent for the other partners. This means that the actions of one partner, within the scope of the business, can bind all other partners and the firm.

- Business: The partnership must be formed for the purpose of carrying on a lawful business, which includes any trade, occupation, or profession. Mere co-ownership of property does not constitute a partnership.

The Indispensable Partnership Deed

The Partnership Deed serves as the blueprint for your partnership firm. It is a legally binding agreements that explain the rights, duties, and obligations of each partner, and the operational aspects of the business. A well-drafted Partnership Deed is crucial for preventing future disputes and ensuring clarity among the partners. Key clauses typically included in a Partnership Deed are:

- Name of the Partnership Firm: A unique and appropriate name for the business. The name should not be similar to any existing firm and should comply with the Emblems and Names (Prevention of Improper Use) Act, 1950. Words suggesting government patronage should also be avoided.

- Nature of the Business: A clear description of the business activities the firm will undertake.

- Duration of the Partnership: Whether the partnership is for a fixed period, a specific project, or is “at will” (meaning it can be dissolved by any partner).

- Names and Addresses of all Partners: Complete details of each partner, including their name, address, and contact information.

- Profit and Loss Sharing Ratio: The agreed profit and loass ratio in which profits and losses will be distributed among the partners.

- Capital Contribution of each Partner: The amount of capital (in cash, kind, or services) contributed by each partner. The deed may also specify provisions for interest on capital and drawings.

- Rights, Duties, and Liabilities of each Partner: A clear mentioning what each partner is entitled to do, their responsibilities and their extent of liability. In a general partnership, the liability of partners is usually unlimited, meaning their personal assets can be used to settle business debts.

- Salary, Commission, or other Remuneration payable to any Partner (if applicable): Details of any compensation to be paid to partners for their active involvement in the firm’s management.

- Procedure for Admission of a New Partner: The process and conditions under which a new partner can be inducted into the firm.

- Procedure for Retirement or Death of a Partner: The steps to be followed when a partner retires, resigns, or passes away, and how the partnership will continue (if at all).

- Method of Settling Disputes among Partners: Mechanisms for resolving disagreements, such as mediation, arbitration, or through legal proceedings.

- Procedure for Dissolution of the Firm: The agreed-upon process for winding up the partnership if the partners decide to dissolve it.

- Bank Account Operation Details: Who is authorized to operate the firm’s bank accounts.

- Any other clauses as agreed upon by the partners: This could include clauses on non-compete, intellectual property rights, or specific operational procedures.

Drafting a comprehensive and legally sound Partnership Deed is important. It is highly recommended to seek the assistance of a legal professional to ensure all necessary clauses are included and the deed adequately protects the interests of all partners while complying with the law. The deed should be printed on non-judicial stamp paper of the appropriate value as per the stamp duty laws of the state where the firm is being formed. All partners must sign the deed in the presence of witnesses, and notarization can add further legal validit

The Process of Partnership Firm Registration

While the specific procedures may vary slightly from state to state, the general process for registering a partnership firm in India involves the following key steps:

- Finalizing the Partnership Deed: As discussed earlier, this is the foundational step. Ensure the deed is comprehensive, legally sound, and executed on the appropriate stamp paper.

- Selecting a Firm Name: Choose a suitable name for your partnership firm, keeping in mind the guidelines mentioned earlier regarding uniqueness, avoidance of offensive or misleading words, and compliance with relevant acts. It’s wise to have a few alternative names in mind.

- Preparing the Necessary Documents: Gather all the required documents for submission to the Registrar of Firms. These typically include:

- Duly signed Partnership Deed: On stamped paper.

- Application for Registration (Form No. 1): This form, prescribed under the Indian Partnership Act, needs to be filled out with details of the firm and the partners and signed by all partners or their authorized agent.

- Identity Proof of all partners: PAN card is mandatory, along with any other government-issued ID (Aadhar card, Voter ID, Passport, Driving License).

- Address Proof of all partners: Ration card, Aadhar card, Voter ID, Passport, Driving License, Bank statement, Electricity bill, Telephone bill (any one recent document).

- Address Proof of the Partnership Firm’s principal place of business: This could be a rental agreement (along with the landlord’s No Objection Certificate and property ownership documents) or ownership documents if the premises are owned. Utility bills (electricity, water, property tax) in the name of the firm or partners at the business address may also be required.

- Affidavit: Typically stating the correctness of the information provided in the application and the Partnership Deed.

- Passport-sized photographs of all partners.

- PAN card of the Partnership Firm: Once the firm name is finalized, an application for the firm’s PAN card needs to be made.

- Digital Signature Certificate (DSC): For online filing in some states, partners may need to obtain a DSC.

- Any other documents as may be required by the Registrar of Firms in the specific state.

- Filing the Application with the Registrar of Firms: The application for registration, along with the necessary documents and the prescribed registration fee, must be submitted to the Registrar of Firms (RoF) in the state where the partnership firm is located. Many states now offer online portals for this process, allowing for electronic submission of documents and payment of fees. In some cases, physical submission might still be required.

- Scrutiny and Registration: Once the application and documents are submitted, the Registrar of Firms will review them for completeness and accuracy. If all requirements are met, the Registrar will record the name of the firm in the Register of Firms and issue a Certificate of Registration. This certificate serves as official proof of the partnership firm’s registration. The process typically takes around 7-10 business days, excluding government approval time. You can often check the registration status online through the RoF’s website

Government Fees for Partnership Firm registration in Dehradun

Government fees of Rs 5,000/- is payable for Partnership Firm registration in Uttarakhand, However it is different in every state. However, if you wish to get certify copy of Form-1 then you will have to pay additionally Rs.100 per page for that. Form -1 is required for opening bank account.

Time Period of Partnership Firm registration

Time period for Partnership Firm registration in Dehradun would be between 15 days to 30 days depending on case-to-case basis.

Post-Registration Formalities: After obtaining the Certificate of Registration, the partnership firm should:

- Obtain a PAN (Permanent Account Number) for the firm: This is essential for tax purposes.

- Obtain a TAN (Tax Deduction and Collection Account Number): If the firm will be deducting tax at source.

- Open a current bank account in the name of the partnership firm: To manage business transactions.

- Obtain GST registration: If the firm’s annual turnover exceeds the prescribed threshold.

Why Register Your Partnership Firm? The Advantages

While registration is optional, choosing to register your partnership firm offers significant advantages:

- Legal Recognition: A registered firm gains a distinct legal identity, separate from its partners, making it easier to enter into contracts, own property, and conduct business in its own name.

- Getting Government Contracts: A registered firm is required when you apply in government contracts in Dehradun as Government ask that your partnership firm should be registered.

- Right to Sue: A registered firm can file lawsuits against third parties to enforce its rights. Unregistered firms face limitations in this regard.

- Right to Be Sued: Third parties can easily sue the registered firm in its own name, providing a clear legal avenue for dispute resolution.

- Claim Against Partners: Registered firms can more easily claim set-offs or initiate legal proceedings against partners.

- Enhanced Credibility: Registration enhances the firm’s credibility and goodwill in the eyes of customers, suppliers, and financial institutions, making it easier to secure loans and business opportunities.

- Easier Access to Finance: Banks and other financial institutions often prefer lending to registered entities due to the legal framework and accountability it provides.

- Smooth Dissolution: In case of dissolution, a registered firm can follow a more structured and legally recognized process.

- Protection of Partner Interests: A registered Partnership Deed clearly defines the rights and responsibilities of each partner, minimizing the potential for future disputes.

- Easier Conversion: A registered partnership firm can be more easily converted into other business structures like a Limited Liability Partnership (LLP) in the future.

The Pitfalls of Remaining Unregistered

Choosing not to register your partnership firm can lead to several disadvantages and limitations:

- Inability to Sue Third Parties: An unregistered firm cannot file a suit in any court against a third party to enforce a contract or recover dues.

- Inability to Claim Set-off: The firm or its partners cannot claim a set-off in a legal proceeding initiated by a third party.

- Partners Cannot Sue Each Other: A partner of an unregistered firm cannot bring a suit against any other partner for the enforcement of any right arising from the partnership agreement.

- Limited Legal Protection: The firm lacks legal standing and recognition, making it vulnerable in legal disputes.

- Difficulty in Obtaining Loans: Financial institutions may be hesitant to lend to unregistered firms due to the lack of legal framework and accountability.

- Lack of Credibility: Unregistered firms may face challenges in building trust and credibility with clients and suppliers.

- Challenges in Owning Property: An unregistered firm cannot own property in its own name; assets have to be held in the names of individual partners, which can lead to complications.

Post-Registration Compliance

While the compliance burden for a partnership firm is generally less than that of a company, certain post-registration compliances need to be adhered to:

- Filing Income Tax Returns: Partnership firms are required to file income tax returns anually in Form ITR-5. The firm is taxed at a 30% rate, and each partner’s share of the profit or loss is also reflected in their personal income tax returns.

- GST Return Filing: If the firm is registered under GST, regular GST returns (monthly, quarterly, or annual, depending on the scheme) need to be filed.

- TDS Compliance: If the firm is deducting tax at source (TDS) on certain payments, it needs to obtain a TAN and file TDS returns.

- Maintenance of Books of Accounts: Proper accounting and financial records need to be maintained, especially if the firm’s turnover exceeds a certain threshold.

- Tax Audit: If the firm’s total business turnover exceeds a specified limit (currently ₹1 crore, with potential for a higher limit under certain conditions), a tax audit by a Chartered Accountant is required.

We provide Partnership Firm Registration services and other related services in all cities of Uttarakhand

NGO Corner is offering Partnership Firm Registration service and other startup registration services in Uttarakhand like Trust Registration,, Society Registration, Digital Signature Certificate, 12A 80G Registration, , Partnership Firm Registration, Company Registration, , Chartered Accountant Consultation, NGO Registration, Income Tax Return Filing, Section 8 Foundation Registration, MSME Udyog Aadhaar Registration, Sole Proprietor Registration, etc for fresh startups and entrepreneurs. We offer the reasonable and ethical professional services in all cities of Uttarakhand like Kaladhungi, Kirtinagar, Gadarpur, Lalkuan, Herbertpur, Ramnagar, Bhimtal, Rishikesh, Udham Singh Nagar, Jaspur, Badrinath, Didihat, Karnaprayag, Mussoorie, Gangotri, Dehradun, Kela Khera, Narendranagar, Srinagar, Uttarakhand, Doiwala, Devprayag, Haridwar, Bageshwar, Dwarahat, Shaktigarh, Manglaur, Rudraprayag, Chamoli, Jhabrera, Dharchula, Mahua Dabra Haripura, Pithoragarh, Almora, Lohaghat, Laksar, Sitarganj, Dineshpur, Nainital, Tanakpur, Pauri Garhwal, Chamba, Uttarkashi, Vikasnagar, Sultanpur, Bajpur, Joshimath, Muni Ki Reti, Tehri Garhwal, Khatima, Kotdwar, Gochar, Mahua Kheraganj, Kedarnath, Pauri, Nandaprayag, Barkot, Kichha, Nagla, Tehri, Landhaura, Dogadda, Champawat, Bhowali, Chamoli Gopeshwar,, Haldwani, Nainital, Bazpur, Kashipur, Rudrapur and many other cities across India. Our charges for Society Registration in Uttarakhand is the cheapest and most affordable. We deliver what we promise always.

Latest questions about Partnership Firm Registration in Dehradun

Partnership Firm Registration is given by Registrar of firm society and chits of state government

Minimum 2 Partners is required to form a partnership Firm

Approx one month