Company Registration Requirements, Procedure and Fees

Company Registration Fees @Rs.14,999/-Only and time period 15-30 days approx.

Call us at 8755017503

100% Approval

100% Online Process

Money back guarantee

Trustworthy Guidance

Company Registration- Overview

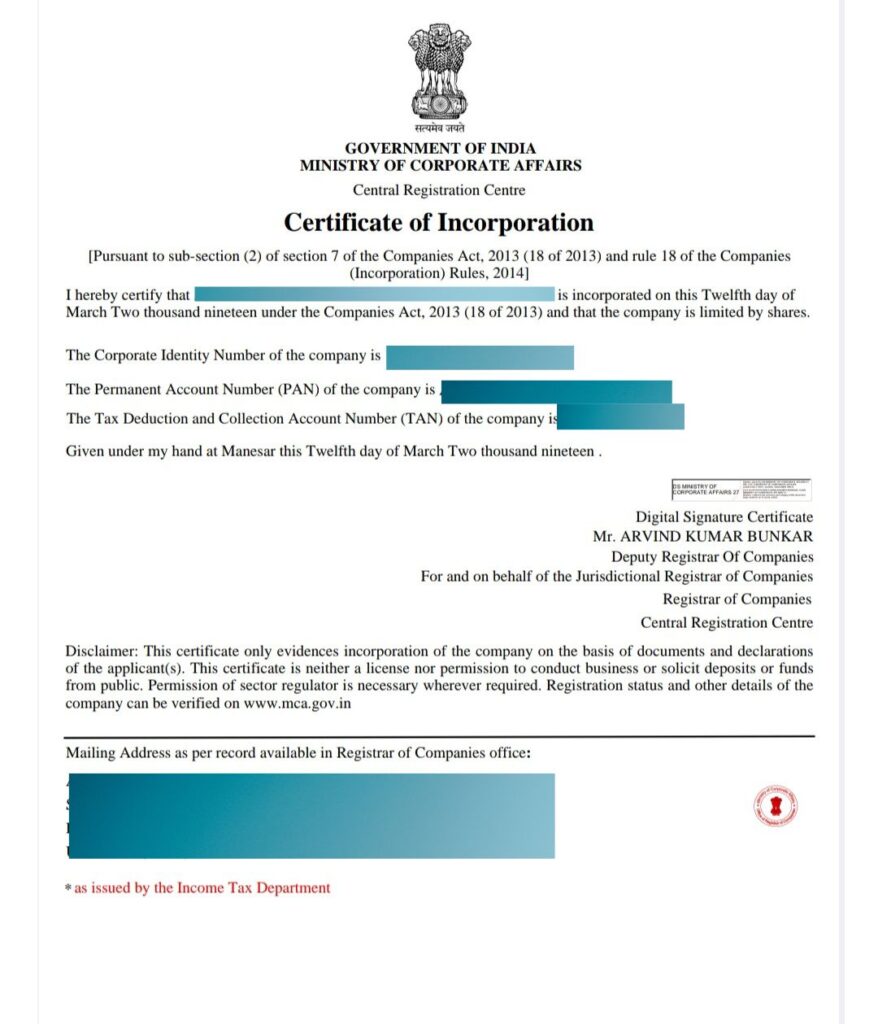

Sample Company Registration Certificate

Company Registration are done online under Companies Act,2013, All process are 100% online. Company may be registered either Private Limited Company or may be Public Limited Company , Section 8 Company and some other classes of Companies

Company Registration

- What is Company Registration

- Benefits of Company Registration

- Documents Required for Company Registration.

- Company Registration Process

- Name Approval Under Companies Act,2013

- What Documents will you get after company Registration

- Compliances after Company Registration.

- Types of Companies under Companies Act,2013

- Benefits of Company Registration with ngocorner

- Frequently Asked Questions.

Visit MCA portal to apply

Company Registration

What is Company Registration–GST Registration of a business organization with the tax authorities indicates obtaining a unique, 15 digit Goods

and Service Tax Identification Number (GSTIN) from the GST department so that all the operations of and

the data of all business organization can be collected and correlated. In any tax system this is the basic requirement for identification of the business for tax purposes or for having any

compliance verification program.

Who Should obtain GST Registration Number – Registration under GST is mandatory for all business organization whose annual turnover exceeds Rs 40 lakhs in a financial year. This threshold Limit is Rs 20 lakhs for special category states such as Arunachal Pradesh, Assam, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand. Registration is also mandatory for all E commerce operator and business who want to sell goods in another state

All About GST Registration Process- Every NGO Which are registered under company act by filing form CSR-1, would be entitled to get CSR Funds by companies having criteria above. Hence, an NGO shall not be entitled to receive CSR funds from a company unless they are registered under CSR by filing form CSR 1. It is mandatory for these NGO/companies / organizations to file e-Form CSR 1 with the Registrar of the Companies to register themselves with the Central Government for doing any kind of CSR activity. It also means that the companies are not allowed to spend CSR funding through an unregistered NGO. It is also important to note that entities which are registered u/s 10(23(c) of the Income Tax Act are not eligible to file Form CSR-1.

Key Component of GST –There are 4 Different Types of GST Components of Tax in India are:

Integrated Goods and Services Tax (IGST)

Central Goods and Services Tax (CGST)

State Goods and Services Tax (SGST)

Union Territory Goods and Services Tax (UTGST)

However there are 5th components which is Cess. Additionally, the government has fixed different GST rates under each components which will be applicable to the payment of tax for goods and/or services rendered.

Documents Required for GST Registration

Sole proprietor / Individual

PAN card of the owner

Aadhar card of the owner

Photograph of the owner in jpeg format, maximum size – 100 KB

Business Place Photograph with longitude and latitude

Address proof-Rent agreement, municipal taxes receipts, latest electricity bill

Partnership firm/ LLP

PAN card of all partners

Copy of partnership deed

Photographs of partners and authorized signatory in jpeg format, maximum size – 100 KB

Address proof of all partner-Aadhar Card, Passport, driving license, Voters identity card, etc.

Aadhar card of authorized signatory

Letter for appointment of authorized signatory

In the case of LLP, Board resolution of LLP and registration certificate

Bank account details*

Address proof for principal place of business-Rent agreement, latest electricity bill, sale deed, municipal taxes copy etc

Company -Public/Private

Certificate of incorporation given by MCA.

Memorandum of Association and Articles of Association

PAN Card and Aadhar card , Voter id card, passport of authorized signatory.

PAN Card and Aadhar cards. Voter id card, passport of directors of the Company

Photographs of directors and authorized signatory

Board resolution for appointment authorized signatory

Bank account details

Address proof of principal place of business- Rent agreement, latest electricity bill, Municipal taxes copy etc.

Photograph of Business with longitude and latitude

GST Registration Fees

There is no Government fees for GST Registration, However Consultants are charging from 2,000 to 10,000 based on their skills. However we charge Rs.5,999/- for GST Registration in Dehradun.

Penalty not having GST Registration

A person who is liable to register under GST and cant do can attract penalties and consequences.

penalties are:

A penalty of Rs. 10,000 or 10% of the tax due, whichever is higher, for not registering despite being required to get registered

The penalty will at 100% of the tax amount due when the taxpayer has deliberately evaded paying taxes

However late fees per day is also charged for delay in filling GST Returns.

Benefits for having GST Registration

Following are benefits after registration of GST

- You can increase your business as many business owner having gst only deal with person having GST number.

- You can sell your goods all over India as selling outside your state need GST Registration and E-way bill is also compulsory for selling goods outside your state.

- After registration your business under GST your business is registered with governemnt.

GST Return Filing

GST Return is a documents containing details of sales, purchase, ITC , goods return, debit note, credit note etc, which need to send to gst department periodically monthly, quaterly, yearly . there are two main gst returns

GSTR-1 and GSTR-3B First Return GSTR-1 filing due date is 11th of next month and GSTR3B Return due date is 20th if each months.

Latest questions about CSR Registration

GST Registration is given by GST department to run business .

Your can grow your business as other business party can make business with you easily

It usually takes 15 to 30 days in Dehradun Uttarakhand